The Disclosure Dividend: turning climate transparency into business value

In an era of intensifying climate risk, environmental disclosure is more than a compliance exercise, it’s a strategic imperative. CDP’s new Disclosure Dividend analysis shows that companies measuring and managing their climate and nature impacts can reap many times the benefits of their investments. Ignoring climate risks could cost the global economy around $38 trillion by 2050, so firms that stay blind to these issues invite financial pain. For example, the European Union’s agriculture sector is already losing €28 billion each year because of extreme weather. These costs are set to grow as the environmental crisis becomes more acute.

By contrast, firms that report and act on environmental data gain clear returns. CDP refers to this as the “disclosure dividend”—the payoff companies receive from disclosing and addressing their environmental risks, impacts, and opportunities. This dividend shows up in three main ways: better access to capital, stronger business resilience, and smoother regulatory preparedness. In short, firms that invest in transparent reporting uncover hidden risks and opportunities, enabling smarter decisions, new revenue streams and investor support in a rapidly changing world. Environmental damage is impacting financial performance.

What is the Disclosure Dividend?

CDP calls the Disclosure Dividend the combined financial and strategic benefits from reporting and acting on climate and nature data. It is not simply a feelgood virtue, but concrete value creation. In practice, the dividend manifests across three use cases: improved access to capital, enhanced business resilience, and stronger compliance readiness. By disclosing emissions, risks, and targets to CDP, companies send a signal of leadership to financiers, which can translate into better lending rates or investment (access to capital). Disclosure also creates latent business risks (e.g. supply chain vulnerabilities, price shocks) and opportunities (new markets for green products), letting firms reinforce their resilience and seize new revenues. Finally, a robust reporting process keeps firms ahead of evolving rules: early transparency makes it easier to comply with tightening carbon pricing, water standards, and other regulations (regulatory preparedness). In each case, proactive disclosure pays off by “enabling better decision-making and attracting investment” and by unlocking new business prospects.

- Access to capital: Transparent disclosure builds trust with investors and lenders. Companies with strong environmental data often enjoy easier financing and attract long-term investors.

- Business resilience: Environmental reporting forces firms to identify weak spots (e.g. supply chain risks) and market openings (e.g. demand for green products). Acting on these insights can dramatically cut future costs and create new value.

- Regulatory readiness: When regulations tighten, disclosing companies avoid scrambling for data. Early disclosure aligns companies with upcoming laws on carbon, water and biodiversity, reducing compliance costs and fines.

The economics of climate disclosure

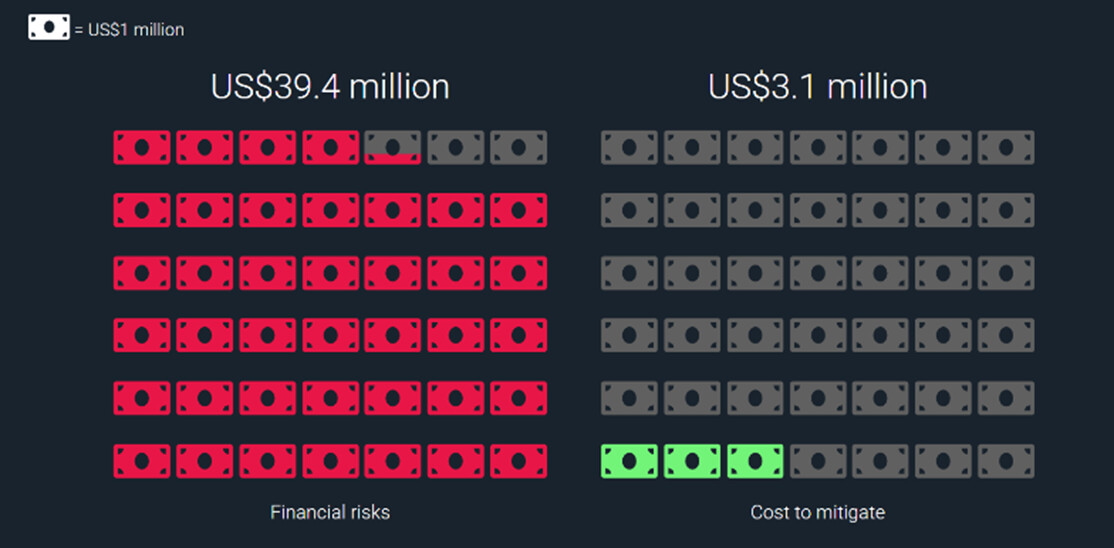

CDP’s 2025 report crunches the numbers. Analysing around 25,000 companies (about two-thirds of global market capitalisation) shows the financial payoff is enormous. In many cases, every $1 spent on mitigating climate risk has delivered around $8 of return, and for some firms, up to $21. On a median basis, disclosed data indicate about $33,1 million in opportunity value per company from environmental actions versus just $4,6 million in implementation costs, a roughly 7:1 benefit to‑ cost‑ ratio. In other words, most companies could capture seven times the benefits of their investment.

Source: CDP The Disclosure Dividend 2025

Furthermore, nearly two-thirds (64%) of companies identified at least one substantive opportunity from taking climate action. Among these, about 12% of firms have already realised a combined $4,4 trillion in value in 2024 alone, while another $13,2 trillion remains on the table. These figures illustrate the massive upside: energy savings, efficiency improvements, revenue from eco-innovations and other “green” opportunities can add up to multitrillion dollar gains for the forward-looking.

Key financial highlights from CDP’s analysis

- For some companies, climate risk spending yielded up to 21× return; on average the payoff was around $8 per $1 invested.

- Median opportunity: approximately $33,1M per company vs. $4,6M cost (7:1 ROI)

- Prevalence of opportunity: 64% of firms identified climate-related opportunities; 12% have realised $4.4T so far, wit, $13,2T more potential.

Building resilience through disclosure

The payoff comes from turning awareness into action—and many companies are already moving in that direction. CDP reports that over 90% of large corporations have processes to identify environmental dependencies and risks, and 67% of all reporting companies (including SMEs) see risks with material financial impacts. The most common concerns are policy changes (28%) and physical threats such as floods, droughts, and wildfires. Identifying these risks is the first step toward resilience.

This insight is driving real measures. Lenovo’s supply-chain climate program, launched in 2022, achieved a 97% CDP supplier response rate, placing it in the top 5% globally. Today, 95% of its suppliers by spend have GHG reduction targets and 76% have renewable-energy goals. By offering tiered support and helping suppliers set science-based targets, Lenovo shows how disclosure can accelerate climate action across the value chain.

Still, gaps remain. Only 43% of large companies (and 15% of SMEs) have a climate transition plan, just 19% use internal carbon pricing, and around 20% have not conducted climate scenario analysis. Moreover, in many industries, more than half of companies have yet to offer low-carbon products, despite rapidly growing demand. CDP’s data make clear: companies embedding disclosure into strategy are ahead—and those who go further stand to unlock even greater value.

The supply chain frontier

An estimated 75% of a company’s total emissions typically lie in its supply chain, as raw materials, components, and logistics carry large environmental footprints (e.g., 40% of EU water demand comes from outside Europe). This makes supplier engagement critical to resilience. CDP data show that incentives work—yet only 11% of companies offer financial or technical support to suppliers. Where they do (e.g., preferential contracts, training, capacity-building), suppliers are 52% more likely to cut emissions.

- Scope of impact: On average, 75% of a company’s climate footprint is upstream. Disruptions in factories or water sources abroad can directly affect business.

- Incentives drive results: Supplier incentives remain rare (11%), but significantly increase climate action (+52% emissions cuts).

- Leading examples: Lenovo’s supplier program achieved a 97% CDP response rate; 94% of its suppliers now track renewable energy use. Grupo Boticário collects emissions data annually through CDP and uses targeted procurement, tailored support, and rewards to drive supplier performance.

These examples show how supplier engagement and data disclosure transform supply chains from blind spots into hubs of innovation, strengthening resilience and reducing reputational and operational risks. Investors and NGOs are also leveraging CDP data. For instance, Green Century, a U.S. sustainable mutual fund, uses CDP’s forest disclosure to pressure companies on deforestation, achieving multiple no-deforestation commitments. This demonstrates how transparent reporting not only guides corporate strategy but also empowers shareholders and civil society to accelerate industry-wide change.

Global variations in opportunities

Source: CDP The Disclosure Dividend 2025

Disclosure data reveal big differences around the world. Japanese companies report by far the largest environmental gains (median $73M per company), far exceeding Chinese companies ($9,8M). European companies typically see risks and opportunities in near balance (around $59M vs $56M). In the U.S., companies identify only $15M of opportunity on average, whereas Canadian firms report about $71M. These gaps reflect variations in industry mix, policy context and even how companies define “opportunity”. CDP cautions that differences in methodology and reporting thresholds can skew absolute comparisons. Still, the global trend is unambiguous: nearly every region and sector stands to gain from acting on environmental data. In aggregate, companies disclosing to CDP have identified over $16 trillion in climate- and nature-related opportunities– a treasure trove for innovation and growth.

Capturing the Disclosure Dividend

To seize these benefits, CDP offers clear guidance. The key is to turn data into decisions:

- Build robust processes: Establish governance (teams and systems) to regularly track environmental dependencies across the organisation and its supply chain

- Know your risks and opportunities: Quantify the financial impact of each material issue. Map where climate, water and biodiversity issues create costs or openings.

- Engage your value chain: Work collaboratively with suppliers and partners. Use incentives, training or shared targets to raise the sustainability of your inputs.

- Strategise and act: Develop a clear environmental strategy and transition plan based on the insights. Set concrete targets (e.g. science-based targets, 1.5°C alignment) and allocate investment to achieve them.

- Innovate green products/services: Launch new low-carbon or resource-efficient offerings to meet demand and capture upside from identified opportunities.

Following these steps ensures disclosure moves beyond transparency into tangible value. As CDP puts it, the dividend is “not simply in awareness, but in translating insight into impact”. In practice, this means embedding environmental intelligence into strategy, R&D and financing decisions so that climate data directly drive growth.

Conclusion: Disclosure as a strategic imperative

The message is clear: sharing environmental data isn’t a burden, it’s smart strategy. CDP’s research shows that the benefits of climate action far outweigh the costs—often by ten times or more. Companies that disclose and act on their impacts cut risks and open new opportunities, while those that don’t face rising costs from disasters and regulation. As CDP’s CEO Sherry Madera puts it, businesses that measure and manage their environmental footprint not only protect their future but also unlock real financial and strategic gains.

Put simply, disclosure has moved beyond box-ticking—it’s becoming an economic necessity. Boards and executives should take note: building CDP disclosure into corporate strategy pays off year after year. Companies that do so can secure better financing, build stronger operations, and position themselves as leaders in the green economy. That’s the heart of the Disclosure Dividend—and the key to long-term success.

Sources: Based on CDP’s 2025 Disclosure Dividend report and related case studies. These sources synthesise findings from nearly 25,000 company disclosures in 2024, illustrating the strategic and financial value of environmental transparency through CDP.